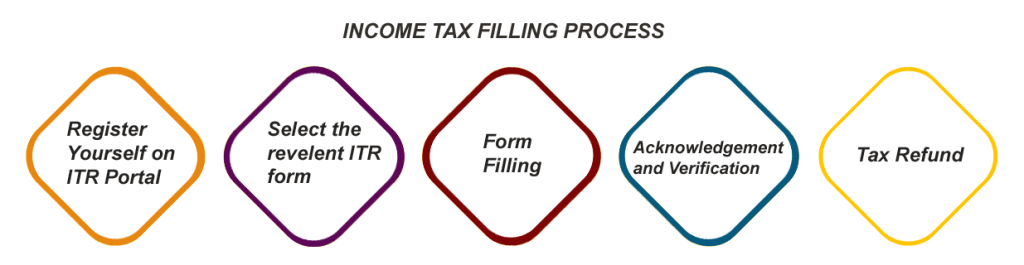

Income Tax Return Filing

Filing income tax returns is a mandatory requirement for individuals and businesses in India. Income tax return filing services help taxpayers navigate this complex process efficiently and accurately.

What these Services Offer:

- Expert Guidance: Yug Legal India experts provide personalized advice on tax laws and deductions applicable to your specific situation.

- Document Organization: Yug Legal India experts assist in organizing and verifying your income and expense documents, including Form 16, bank statements, and investment proofs..

- Return Preparation and Filing: Yug Legal India expertsprepare your income tax return (ITR) using the appropriate forms and file it electronically through the Income Tax Department’s e-filing portal.

- Error Checking and Validation: Yug Legal India expertsensure accuracy and completeness of your return, minimizing the risk of errors and notices from the tax department.

- Tax Optimization: Yug Legal India expertshelp you identify eligible deductions and exemptions to minimize your tax liability legally.

- Refund Assistance: Yug Legal India experts track your refund status and address any issues related to refund processing.

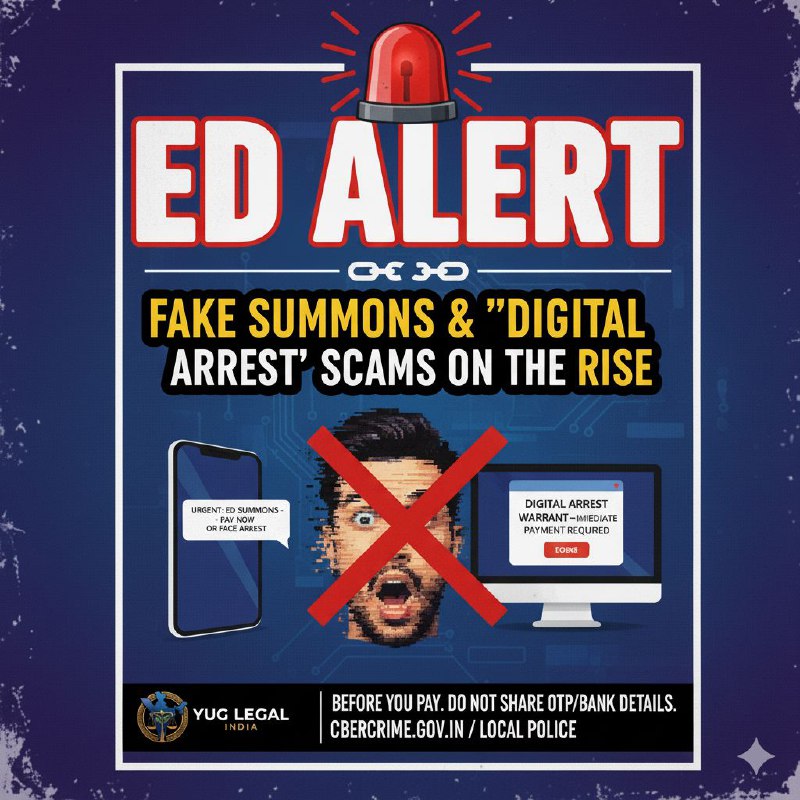

- Representation before Tax Authorities: In case of notices or scrutiny, some services also offer representation before tax authorities.

Benefits of Using Income Tax Return Filing Services of Yug Legal India:

- Saves Time and Effort: Avoid the complexities of understanding tax laws and navigating the e-filing portal.

- Reduces Errors: Yug Legal India expertsensure accurate and complete returns, minimizing the risk of penalties and notices.

- Maximizes Tax Savings: Yug Legal India expertshelp you claim all eligible deductions and exemptions to reduce your tax burden.

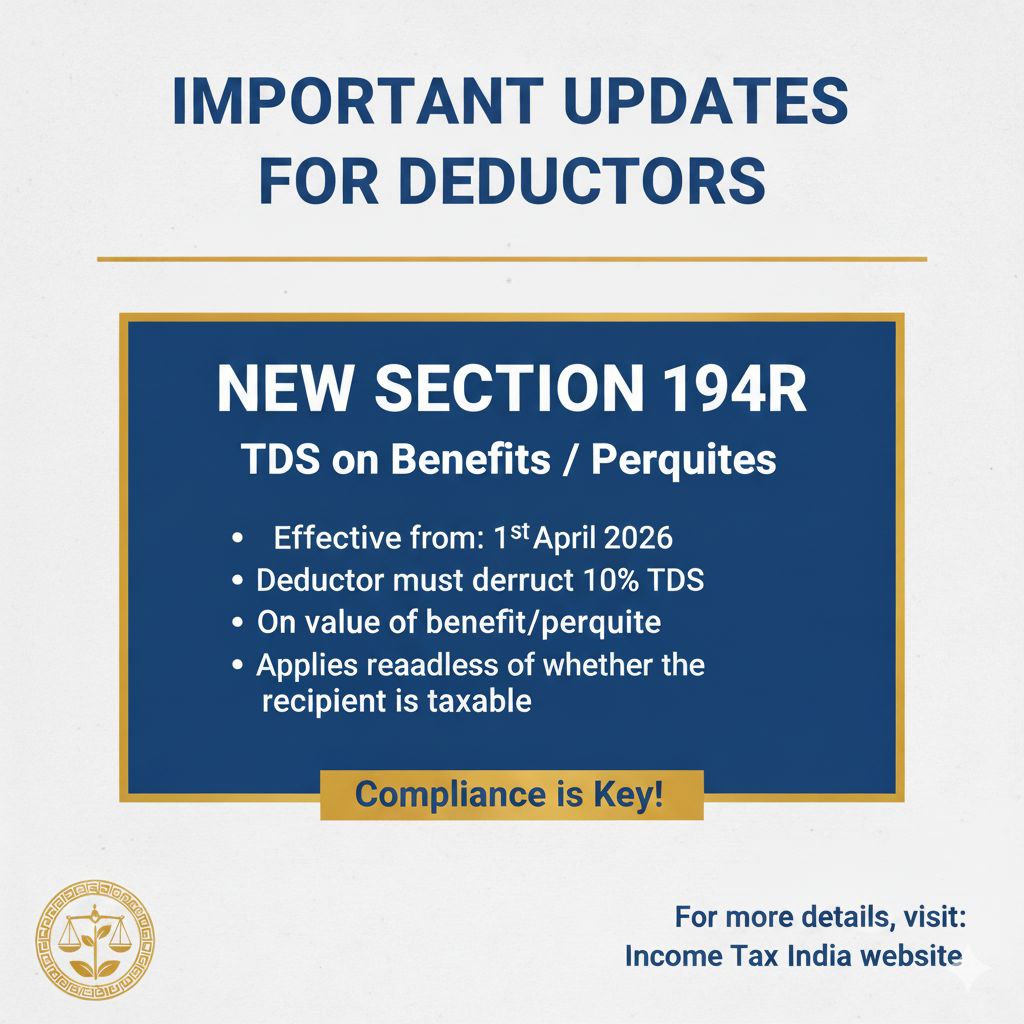

- Ensures Compliance: Stay compliant with income tax laws and avoid legal issues.

- Provides Peace of Mind: Focus on your work or business while experts handle your tax filing obligations.

By utilizing professional income tax return filing services of Yug Legal India, taxpayers can simplify the filing process, ensure accuracy and compliance, and potentially save money on taxes.