GST Update – GSTR-9 Enabled for FY 2024-25

GST Update – GSTR-9 Enabled for FY 2024-25! What’s New: The GST portal has now enabled filing of Annual Return (Form GSTR-9) for the financial year 2024-25. Taxpayers can now log in and start preparing their yearly GST summary of sales, purchases, tax paid & ITC claimed. Key Highlights: What You Should Do: File early, […]

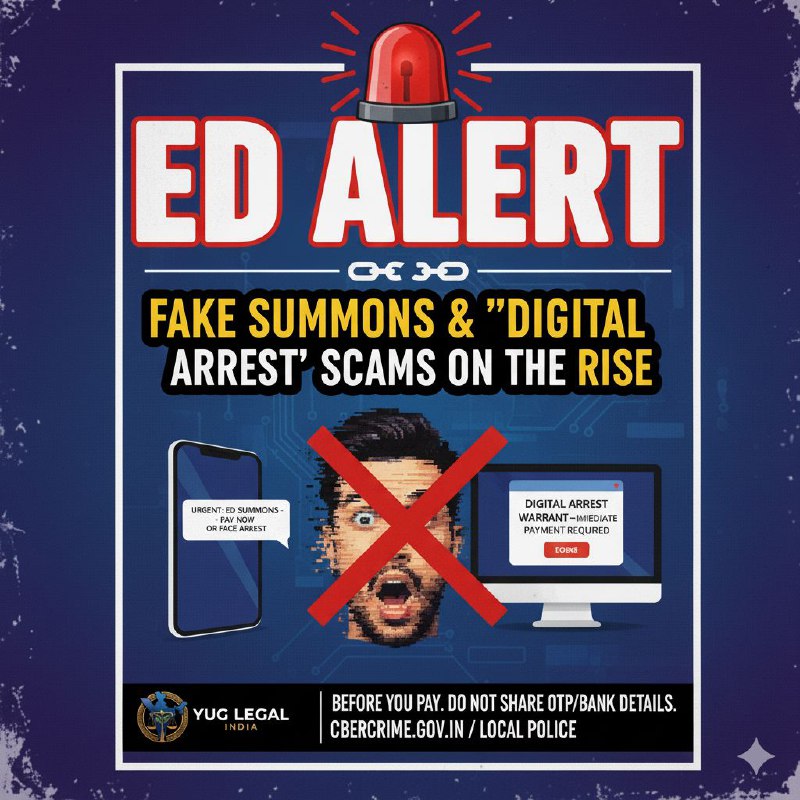

ED ALERT – Fake Summons & “Digital Arrest” Scams on the Rise!

ED ALERT – Fake Summons & “Digital Arrest” Scams on the Rise! The Enforcement Directorate (ED) has officially warned citizens about fraudsters pretending to be ED officers — sending fake summons, threatening “digital arrests”, and extorting huge amounts of money. What’s Happening: Scammers pose as ED officials on calls or WhatsApp video chats. They send […]

GSTN Clarification

GSTN Clarification – No Change in Auto ITC or GSTR-3B Filing! GSTN has noticed fake posts spreading confusion about ITC changes from 1 Oct 2025. It has officially clarified the facts as under: Auto-Population of ITC (No Change) Input Tax Credit (ITC) will continue to auto-populate from GSTR-2B → GSTR-3B automatically. No manual intervention required. […]

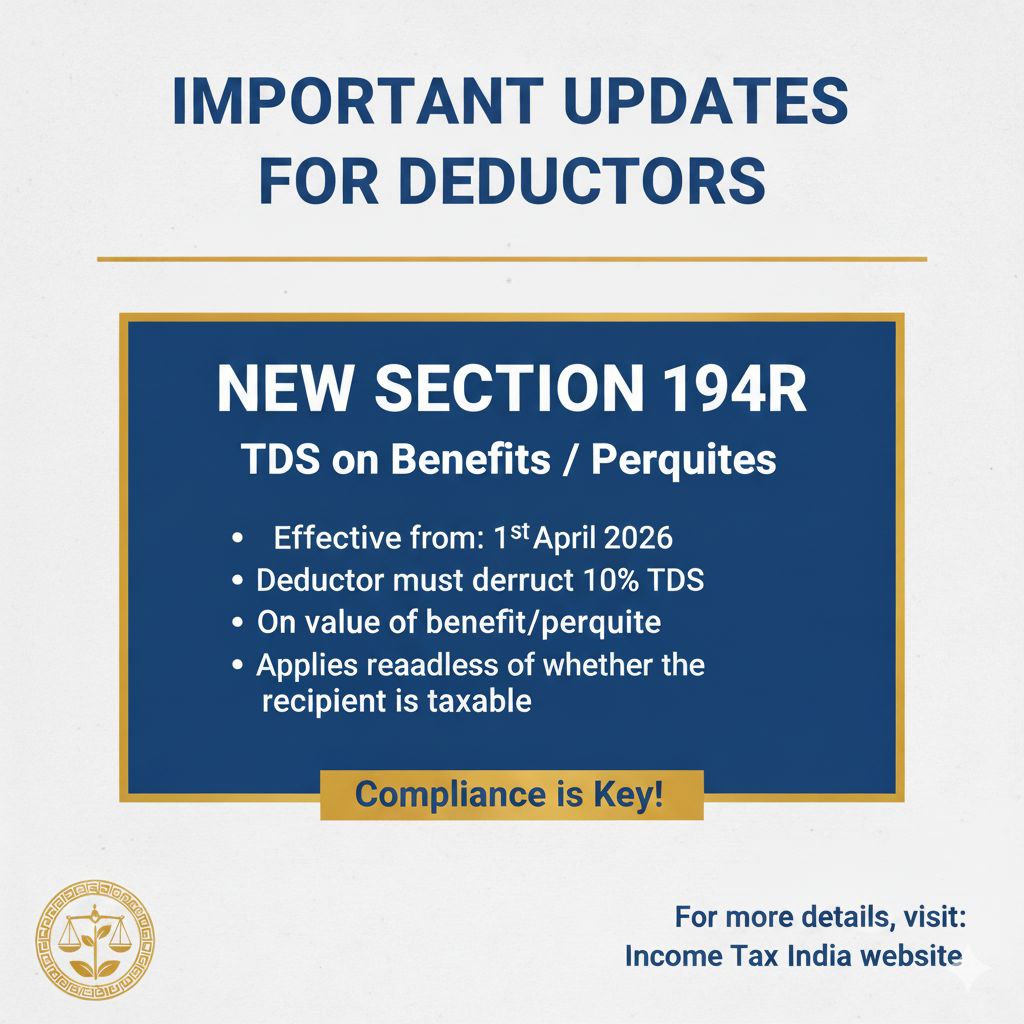

IMORTANT UPDATES FOR DEDUCTORS

FOR DEDUCTORS/ COLLECTORS IMPORTANT UPDATE As per the new Income Tax Act, 2025 (effective 1 April 2026): The old Income Tax Act, 1961 will stand repealed. Under Section 397(3)(f), deductors/collectors can now file TDS/TCS correction statements within 2 years from the end of the relevant tax year. Earlier: No fixed long-term window for corrections. Now: […]

RBI Simplifies External Borrowing Rules under FEMA!

Big move for corporates, NBFCs & start-ups looking to raise funds from abroad! Source: RBI Discussion Paper (Sept 2025) What’s Changing? -The Reserve Bank of India (RBI) has proposed a major simplification of the entire External Commercial Borrowing (ECB) framework — making it easier for Indian entities to borrow money from abroad. -Instead of juggling […]

Goods and Services Tax (GST)

Goods and Services Tax (GST) Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax levied on every value addition of goods and services. Implemented in India on July 1, 2017, it replaced a complex web of central and state indirect taxes with a single, unified system. The core principle of GST is “One […]

Now Access whatsapp Chats Data By Indian Government

With the latest Income Tax Bill 2025, the government has proposed new changes in the Income Tax Act to improve the laws related to tracking digital assets. The changes are proposed because the old Income Tax Act, 1961 did not have enough legal support to properly investigate the digital assets. Finance Minister Nirmala Sitharaman explained […]