Blog and News

- Home

- Blog and News

GST Update – GSTR-9 Enabled for FY 2024-25

GST Update – GSTR-9 Enabled for FY 2024-25! What’s New: The GST portal has now enabled filing of Annual Return…

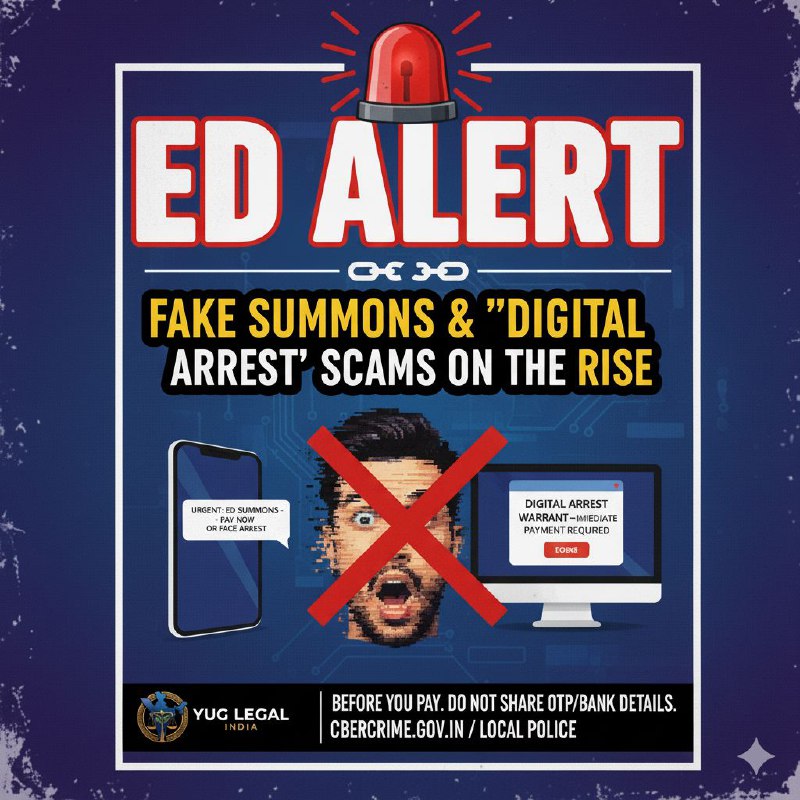

ED ALERT – Fake Summons & “Digital Arrest” Scams on the Rise!

ED ALERT – Fake Summons & “Digital Arrest” Scams on the Rise! The Enforcement Directorate (ED) has officially warned citizens…

GSTN Clarification

GSTN Clarification – No Change in Auto ITC or GSTR-3B Filing! GSTN has noticed fake posts spreading confusion about ITC…

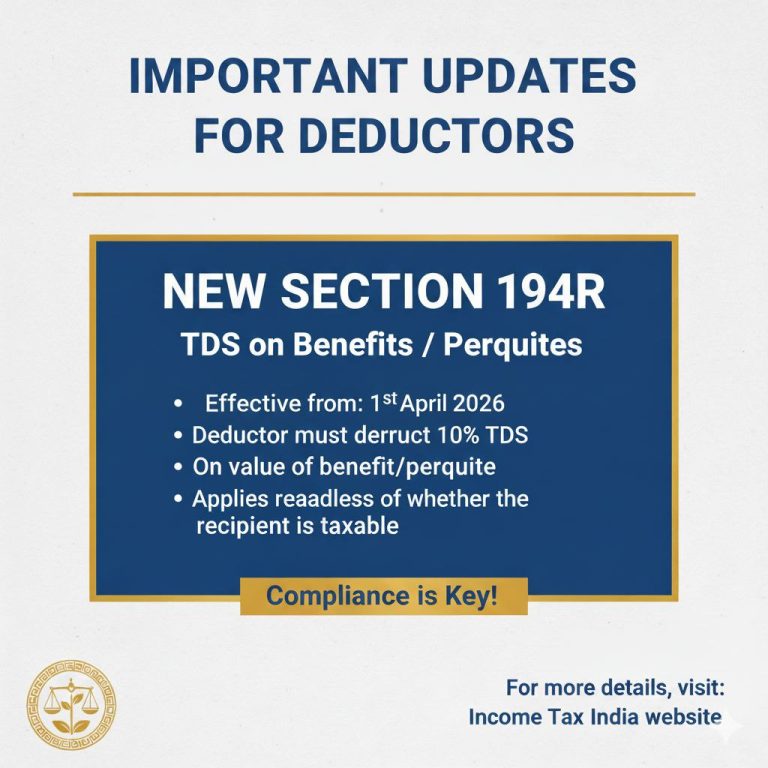

IMORTANT UPDATES FOR DEDUCTORS

FOR DEDUCTORS/ COLLECTORS IMPORTANT UPDATE As per the new Income Tax Act, 2025 (effective 1 April 2026): The old Income…

RBI Simplifies External Borrowing Rules under FEMA!

Big move for corporates, NBFCs & start-ups looking to raise funds from abroad! Source: RBI Discussion Paper (Sept 2025) What’s…

Goods and Services Tax (GST)

Goods and Services Tax (GST) Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax levied on every value…