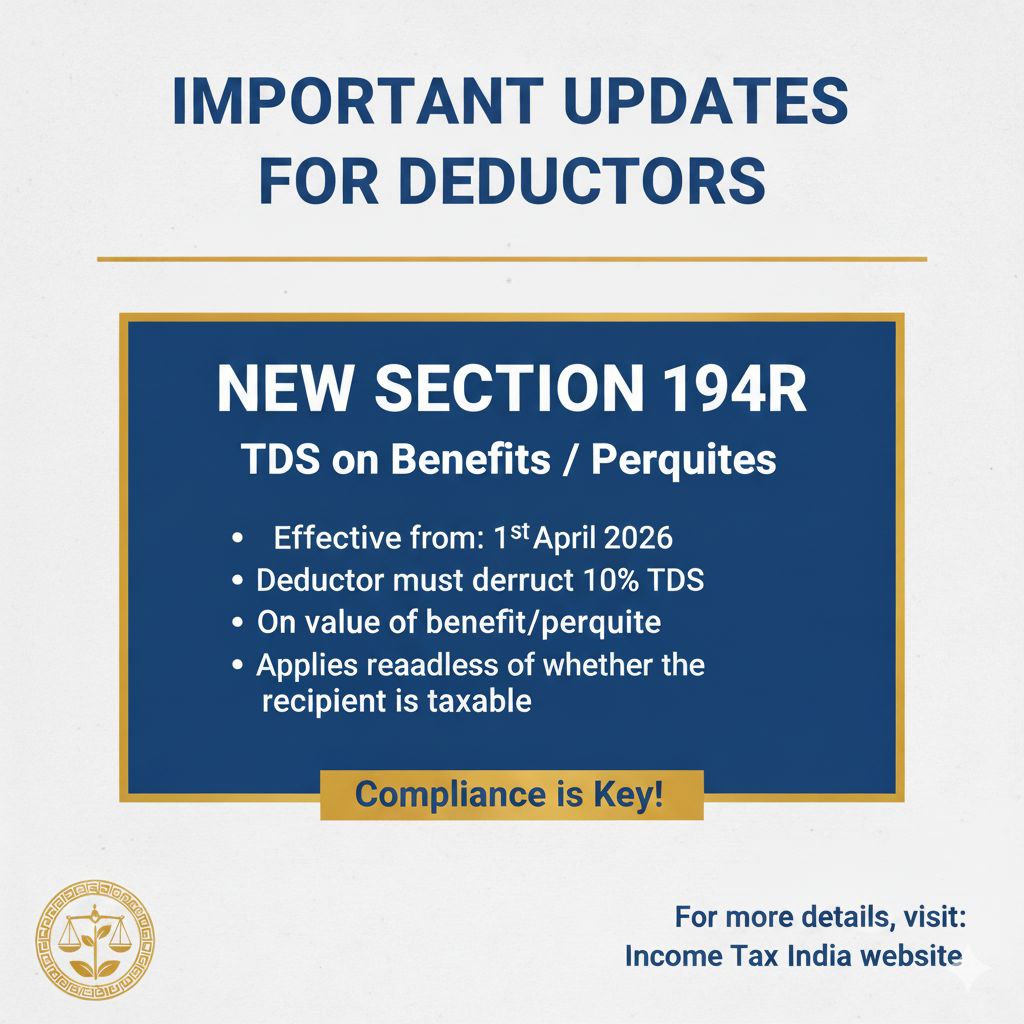

FOR DEDUCTORS/ COLLECTORS IMPORTANT UPDATE

As per the new Income Tax Act, 2025 (effective 1 April 2026):

The old Income Tax Act, 1961 will stand repealed.

Under Section 397(3)(f), deductors/collectors can now file TDS/TCS correction statements within 2 years from the end of the relevant tax year.

Earlier: No fixed long-term window for corrections.

Now: Clear 2-year timeline = more flexibility, but also responsibility to update filings promptly.

Action Point:

All deductors, collectors, and accountants should note the revised timeline and plan corrections accordingly.

Stay Connected! Stay Informed! @YUGLEGALINDIA